are dental implants tax deductible in the united states

You can deduct 5 of your gross income. Yes dental implants are an approved medical expense that can be deducted on your return.

Dental Insurance Coverage And Cost Forbes Advisor

Dental implants are tax deductible so thats good news.

. The deduction is not automatically deducted however so you will need to itemize your deductions in order to claim it. The Medical Expense Tax Credit METC is a non-refundable tax credit that you can use to reduce the tax that you paid or may have to pay. If you hire an accountant to do your taxes just let him know about your implants and they will know what to do.

Its not that far fetched to think that missing a bunch of teeth might hinder your prospects in a. Only medically necessary dental treatments are deductible such as teeth cleanings sealants fluoride treatments X-rays fillings braces extractions dentures and dental-related prescription medications. New Smile In One Day.

The important thing is to use the money you transfer to that account before the end of the year. Ad We Offer Flexible Payment Options Financing. The tool is designed for taxpayers who were US.

This includes fees paid to dentists for X-rays fillings braces extractions dentures etc. You can claim dental expenses on your taxes if you incurred fees for the prevention and alleviation of dental disease. If you were reimbursed or if expenses were paid out of a Health Savings Account or an Archer Medical Savings Account.

Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI. Employer-sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan arent deductible unless the premiums are included in box 1 of your Form W-2 Wage and Tax Statement. The year in which the expenses were paid.

Information Youll Need. The deduction is not automatically deducted however so you will need to itemize your deductions in order to claim it. Claiming dental expenses is an allowable deduction on your tax return.

Any 7 should be remembered as a good thing. Application of sealants and fluoride treatments to prevent tooth decay. Type and amount of expenses paid.

You can include in medical expenses the amounts you pay for dental treatment. Citizens or resident aliens for the. Dental implants are tax deductible so thats good news.

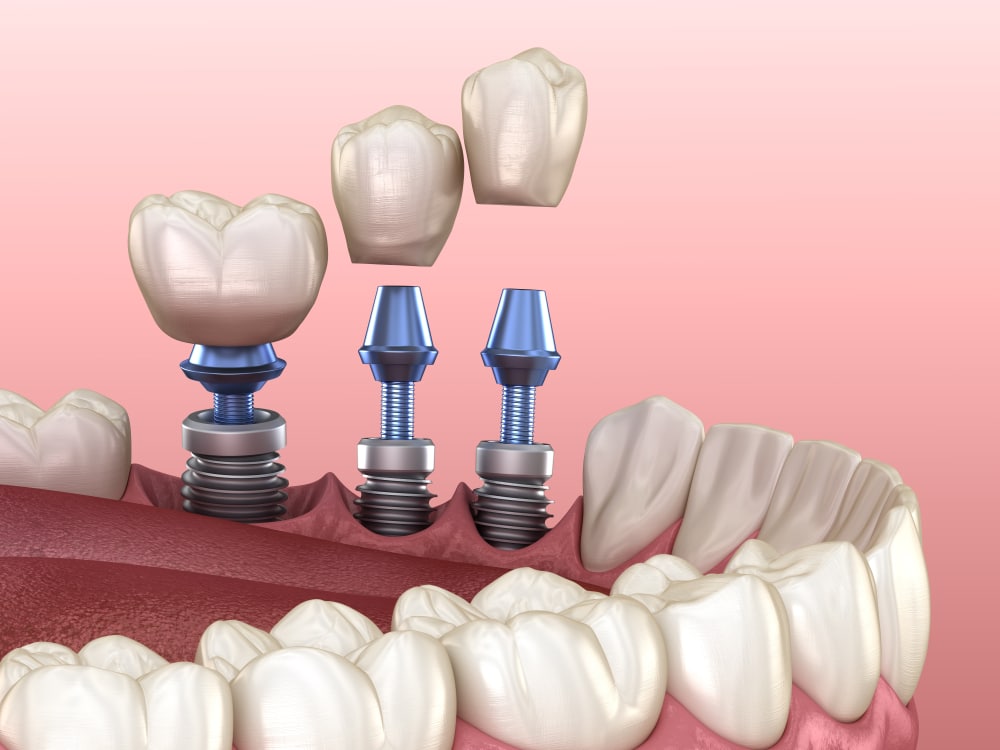

Yes you can claim your implants and dentures along with all other medical expenses and health insurance premiums paid out-of-pocket as Medical Expenses on Schedule A - Itemized deductions. Dental implants are considered a medical expenses. Services of a dental hygienist or dentist for teeth cleaning.

If you are 65 or over they are deductible to the extent they exceed 75 Please click here for more information. You can deduct 5 of your gross income. If one or two crowns are placed to rehabilitate your bite due to an accident illness or disease they.

In order to deduct the cost of the dental implant you would need to do that in Schedule A on your taxes. Your adjusted gross income. One Price For Entire Treatment.

Call Us To Schedule A No-Commitment Visit. Your dentist would not implant them unless they were a medicaldental necessity even if the procedure was elective. Lets look at what can and cannot be claimed on your tax return as well as how to claim these expenses.

Use your FSA funds to finance dental implants. Write a check or pay with a debit card directly to your dentist. Any 7 should be remembered as a good thing.

Cosmetic procedures like veneers and teeth whitening and non-prescription medicines are not tax-deductible. For example if youre a federal employee participating in the premium conversion plan of the Federal Employee. The IRS states that the total paid for dental implants can be reported as a medical expenditure on Schedule A Itemized Deductions.

Craziest tax deductions. Most non-cosmetic dental expenses are tax deductible. By being tax-deductible it means you can get a portion of the cost back in your next tax return.

The IRS states that the total paid for dental implants can be reported as a medical expenditure on Schedule A Itemized Deductions. You can claim both your payment in cash and the part financed with a loan if the loan has been disbursed. This money is both tax-deductible and before taxes so you can use those savings to lower your overall costs.

Did you know your dental implants may be tax-deductible. You can claim eligible dental expenses paid in any 12-month.

What Medical Expenses Are Tax Deductible The Turbotax Blog

Is Invisalign Tax Deductible Dr Hall Media Center

/GettyImages-184878144-fad59359c24245ceb97dafe44c6d0e9e.jpg)

Is Dental Insurance Tax Deductible

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

How To Afford Dental Implants Without Going Broke Dental Implants Dental Implants

Are Dental Expenses Deductible Atlantic Dental Partners

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry

Dental Implant Cost Dental Implants Start From 900

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

How Much Does A Tooth Implant Cost With Insurance Insurance Noon

Here Is What A Bcbsnc Member Id Card Looks Like What Is Health Health Insurance Health Care Insurance

A Tax Deduction For Invisalign The Studio For Exceptional Dentistry

Are Dental Implants Tax Deductible Drake Wallace Dentistry

3 Irs Dental Implant Discount Plans Tax Deductible Savings Dental Implants Irs Taxes Tax Deductions

Dental Implant Cost Near Me Clear Choice Cost Maryland

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry

/DentalInsurance-bdd75e233ce941238fc67be87ef17da9.jpeg)