closed end credit disclosures

If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance. The premium may be disclosed on a unit-cost basis only in open-end credit transactions closed-end credit transactions by mail or telephone under 102617g and certain closed-end credit.

Can I Get A Hud Florida Agency Network

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures.

. If disclosures are delayed until conversion and the closed-end transaction has a variable-rate feature disclosures should be based on the rate in effect at the time of. The disclosure rules of Regulation Z differ depend ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages. 102622 Determination of annual percentage rate.

22617 General disclosure requirements. 102659 Reevaluation of rate increases. 22618 Content of disclosures.

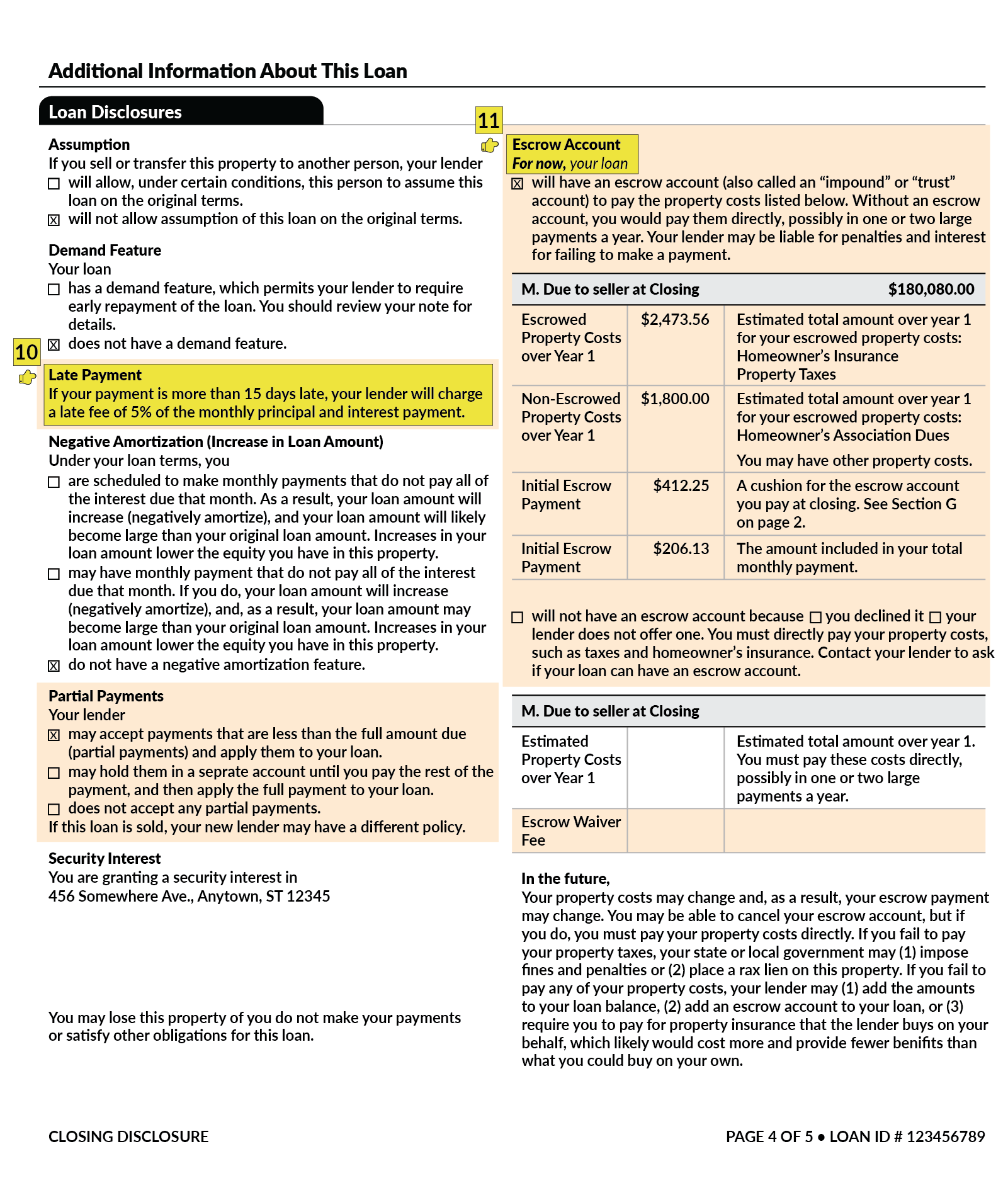

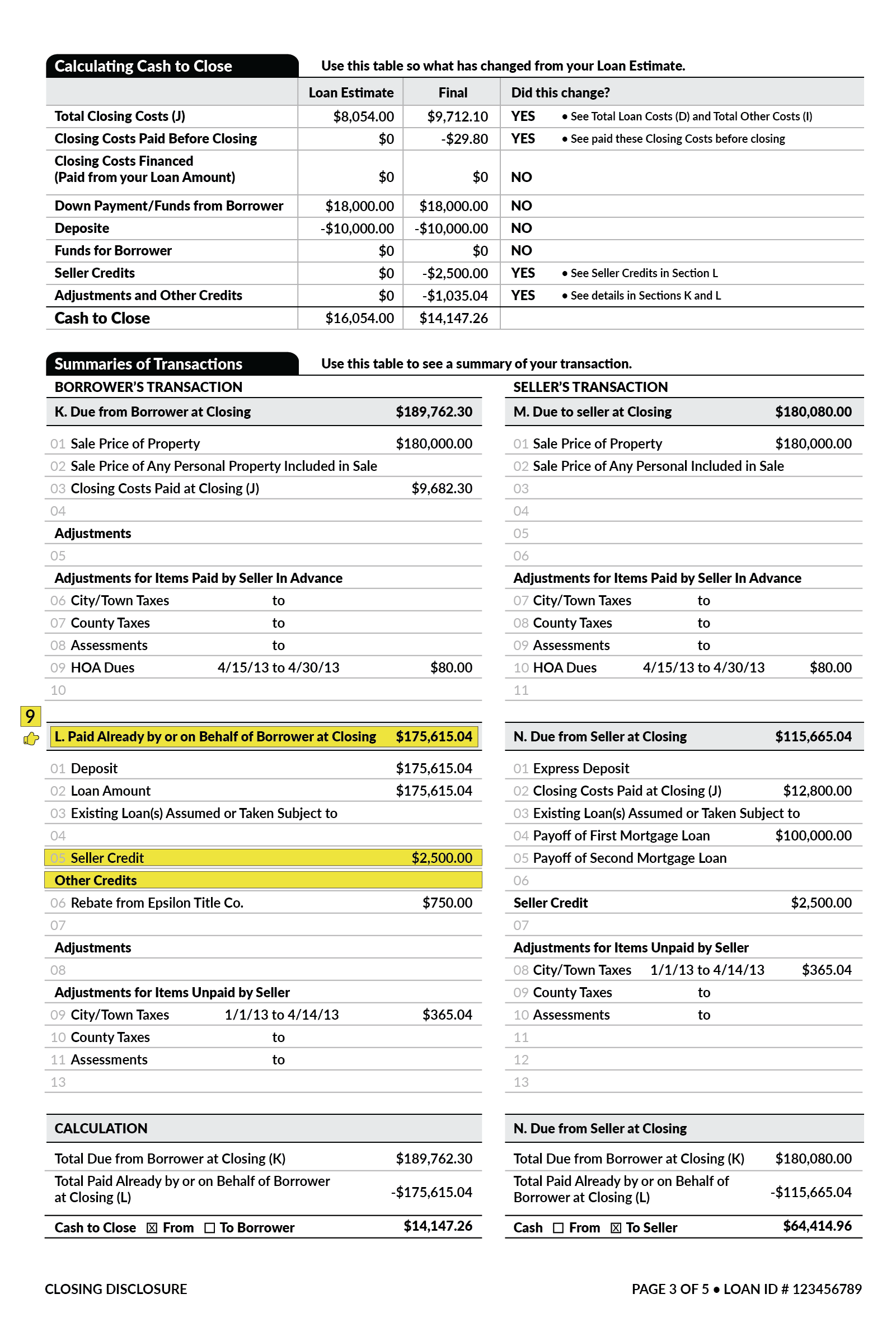

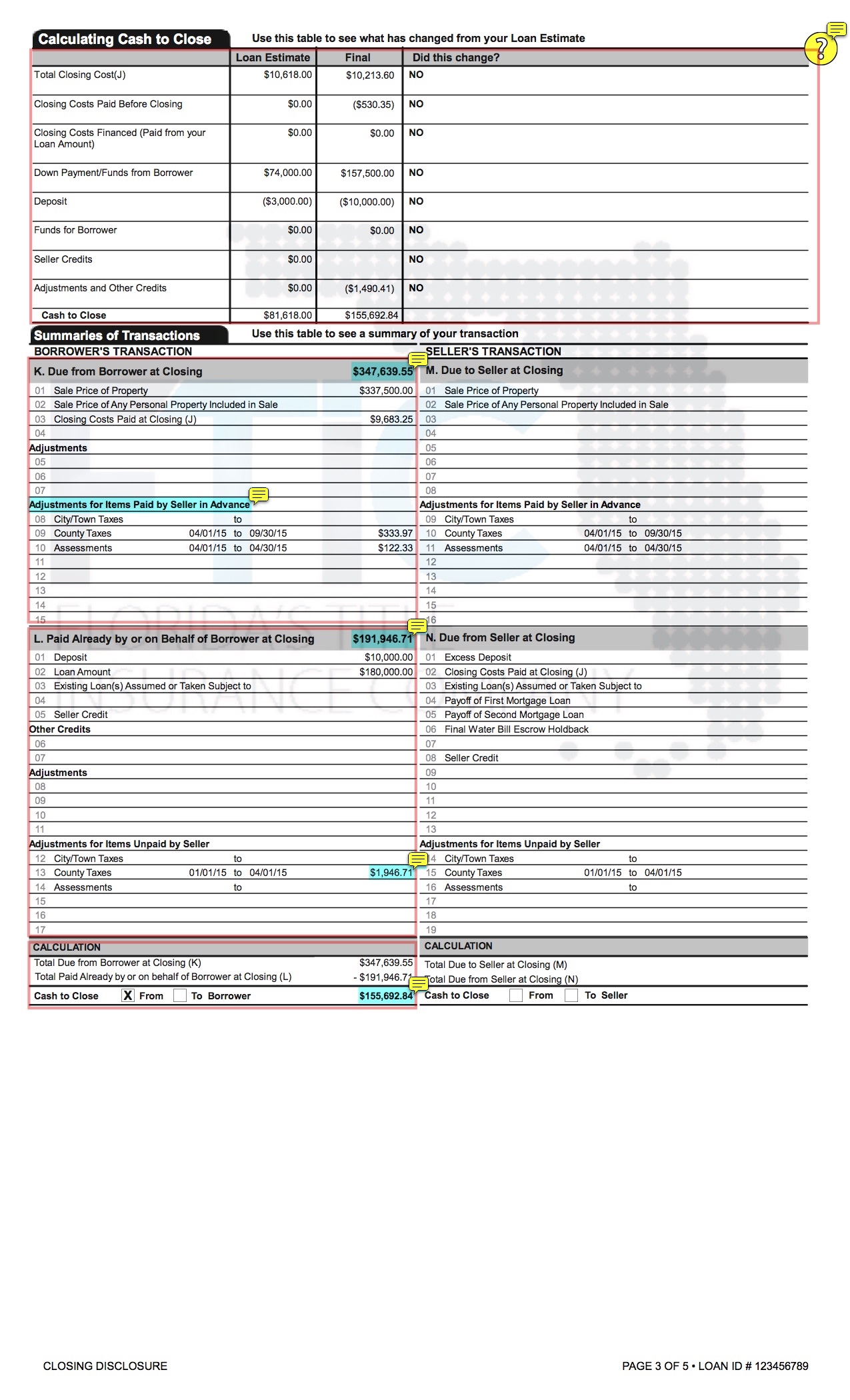

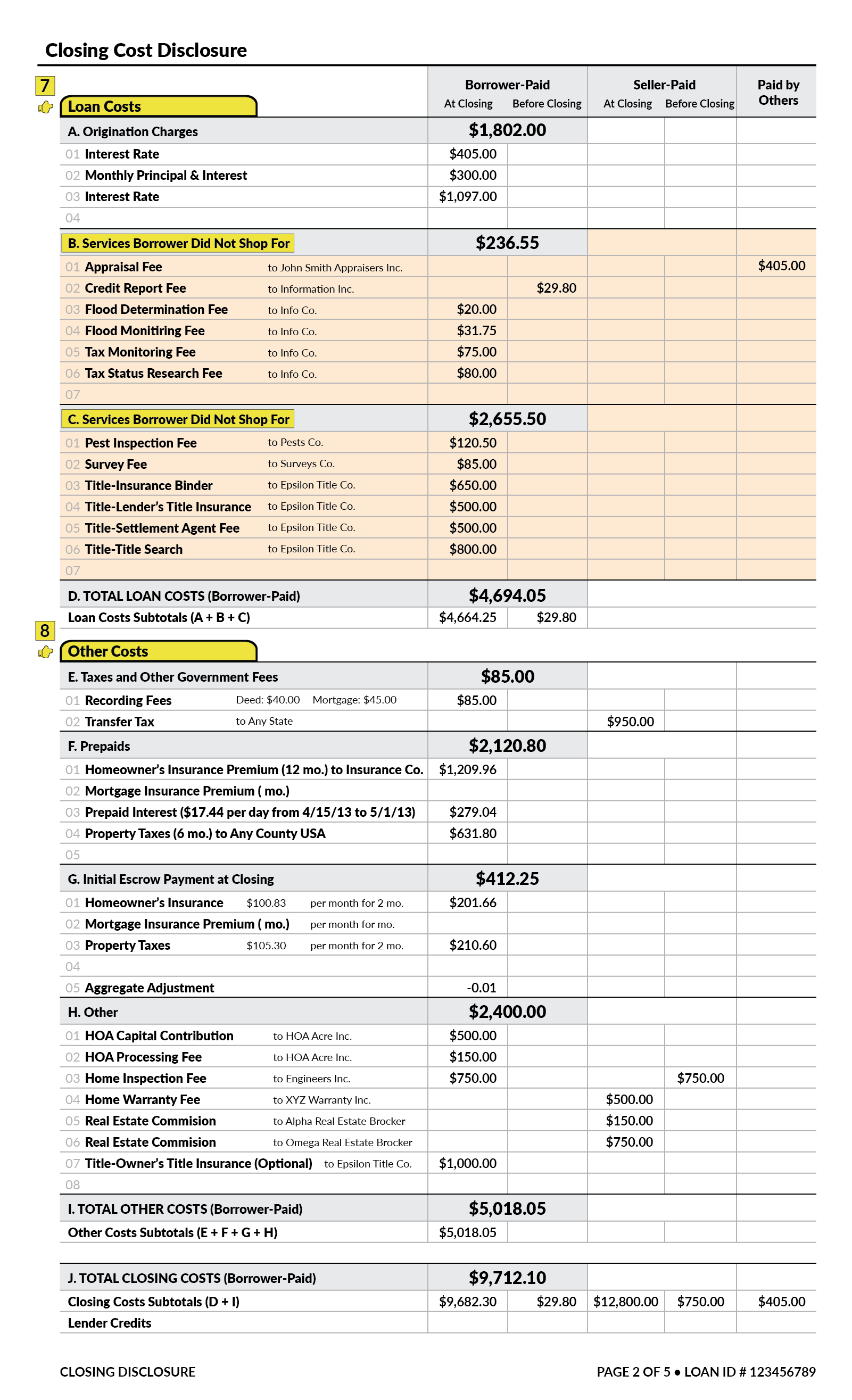

In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the form. 12 CFR Subpart C - Closed-End Credit. Closed-End Credit Disclosure Forms.

If any triggering term is used in a closed-end credit advertisement then the following three disclosures must also be included in that advertisement. 102617 General disclosure requirements. 12 CFR Subpart C - Closed-End Credit.

Open-end credit is not restricted to a specific. 22619 Certain mortgage and variable-rate transactions. 22623 Right of rescission.

In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a. 2268 is the principal section for closed end credit disclosures. For a closed-end credit transaction subject to 102619e and f opens new window real property or a.

22621 Treatment of credit balances. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was. Determine that the disclosures are clear conspicuous and grouped together or segregated as required in a form the consumer.

102619 Certain mortgage and variable-rate transactions. The disclosures required under subsection a with respect to any open end consumer credit plan which provides for any extension of credit which is secured by the consumers principal. The Credit Union will provide the proper closed-end disclosures to the consumer borrower before consummation of the transaction.

Item Description Yes No NA. Sub-sections a and b cover all types of closed end transactions and then the various following subsections have specific. 102620 Disclosure requirements regarding post-consummation events.

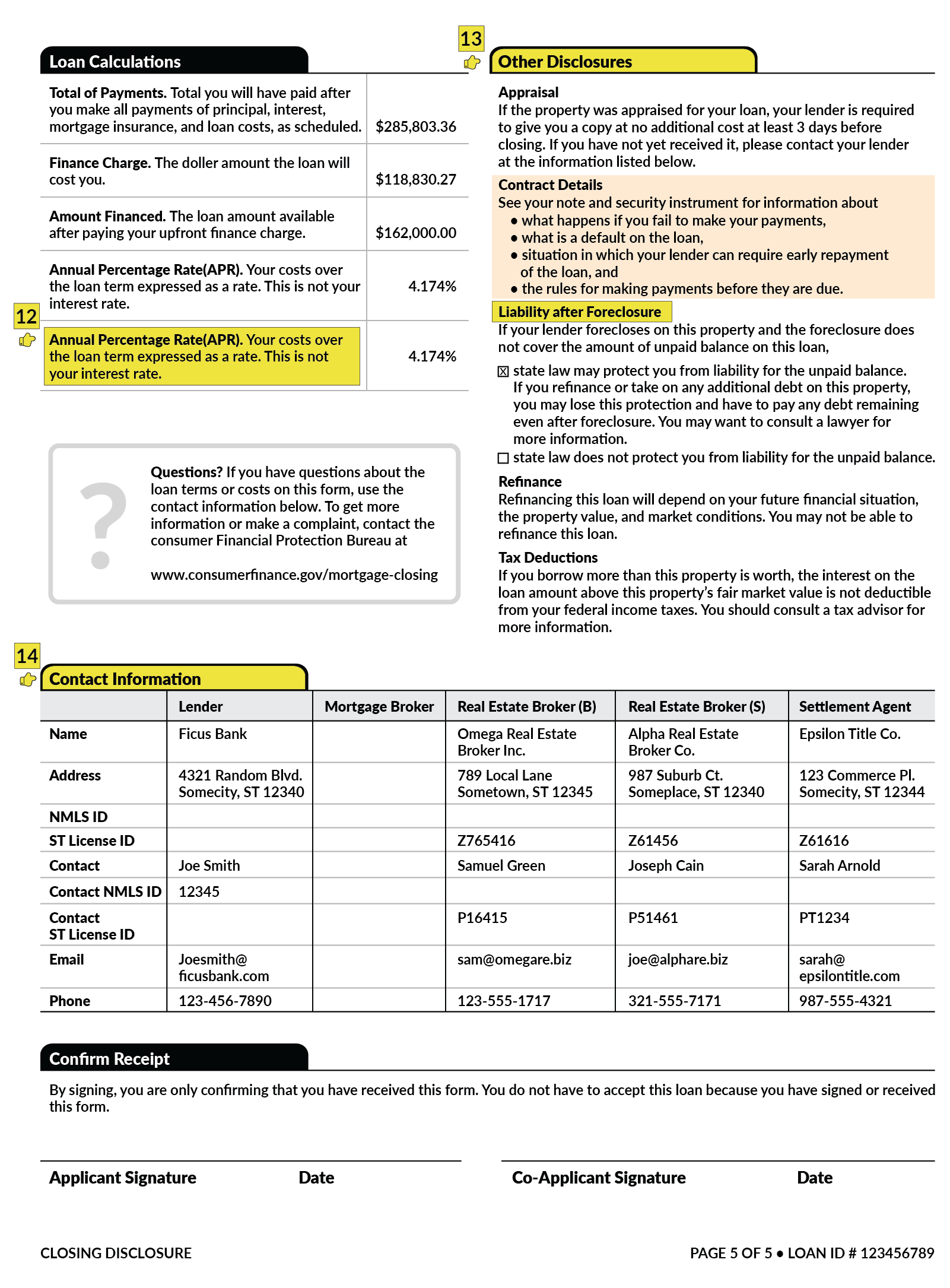

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. Regulation Z now contains two new forms required for most closed-end consumer mortgage loans. 102621 Treatment of credit balances.

102658 Internet posting of credit card agreements. A trigger term is an advertised term that requires additional disclosures. Section 102632 requires certain disclosures and provides limitations for closed-end credit transactions and open-end credit plans that have rates or fees above specified amounts or.

Closed-End Credit Disclosure Forms Review Procedures a. The Loan Estimate is provided within three business days from application and the. 22622 Determination of annual percentage rate.

Annual Percentage Rate Definition 12 CFR 102622 Closed-End Credit 28 SUBPART B OPEN-END CREDIT 31 Time of Disclosures Periodic Statements 12 CFR 10265b 31 Subsequent. 1 The amount or percentage of any. 2268 is the principal section for closed end credit disclosures.

22620 Subsequent disclosure requirements. 102657 Reporting and marketing rules for college student open-end credit. Trigger terms when advertising a closed-end loan include.

102618 Content of disclosures.

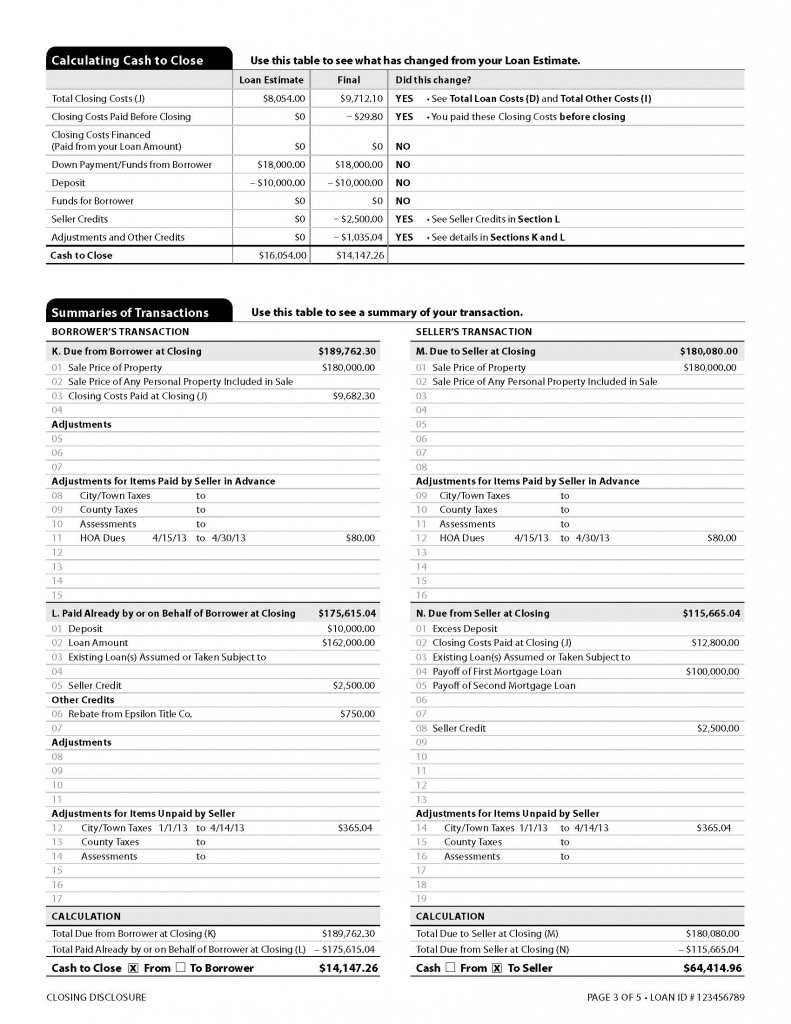

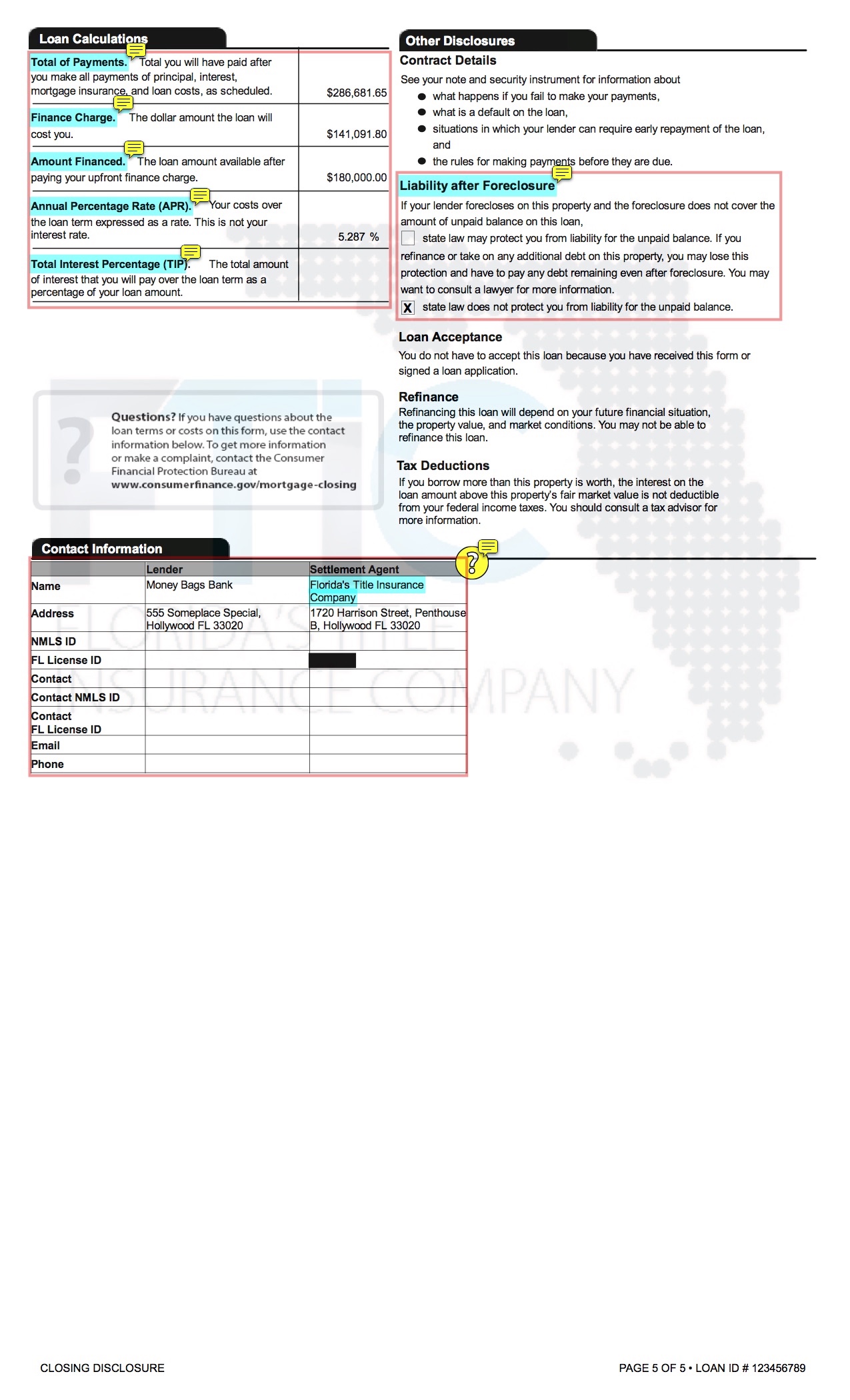

What Is A Closing Disclosure Lendingtree

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Federal Register Truth In Lending Regulation Z

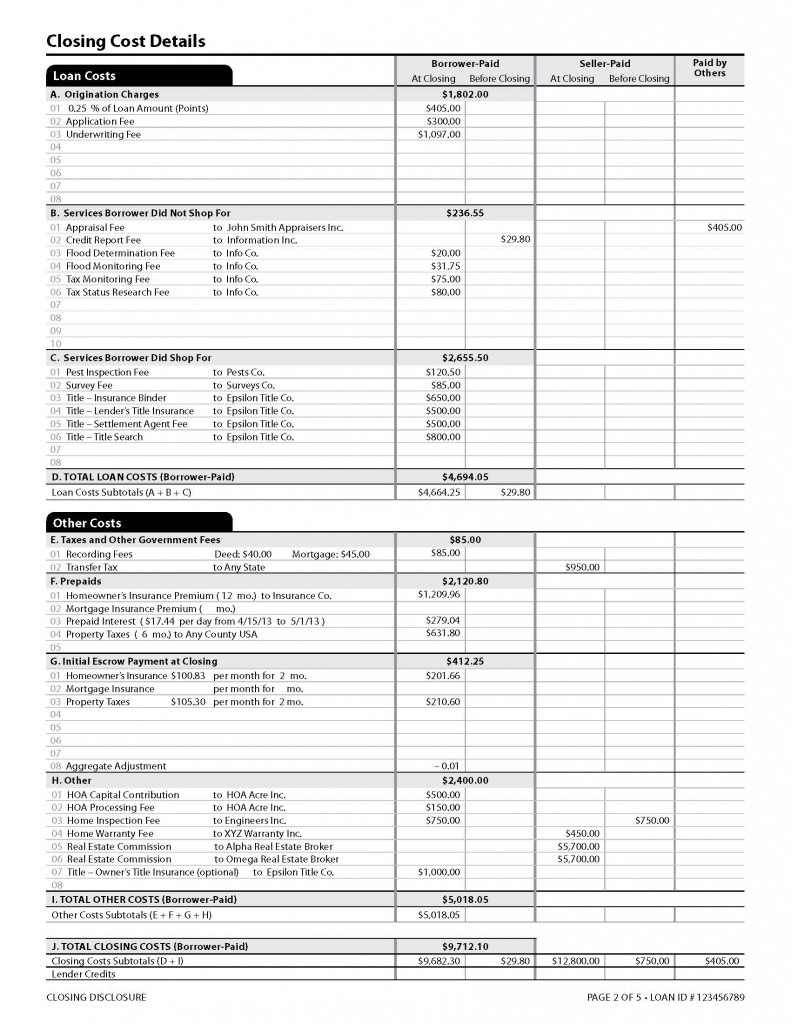

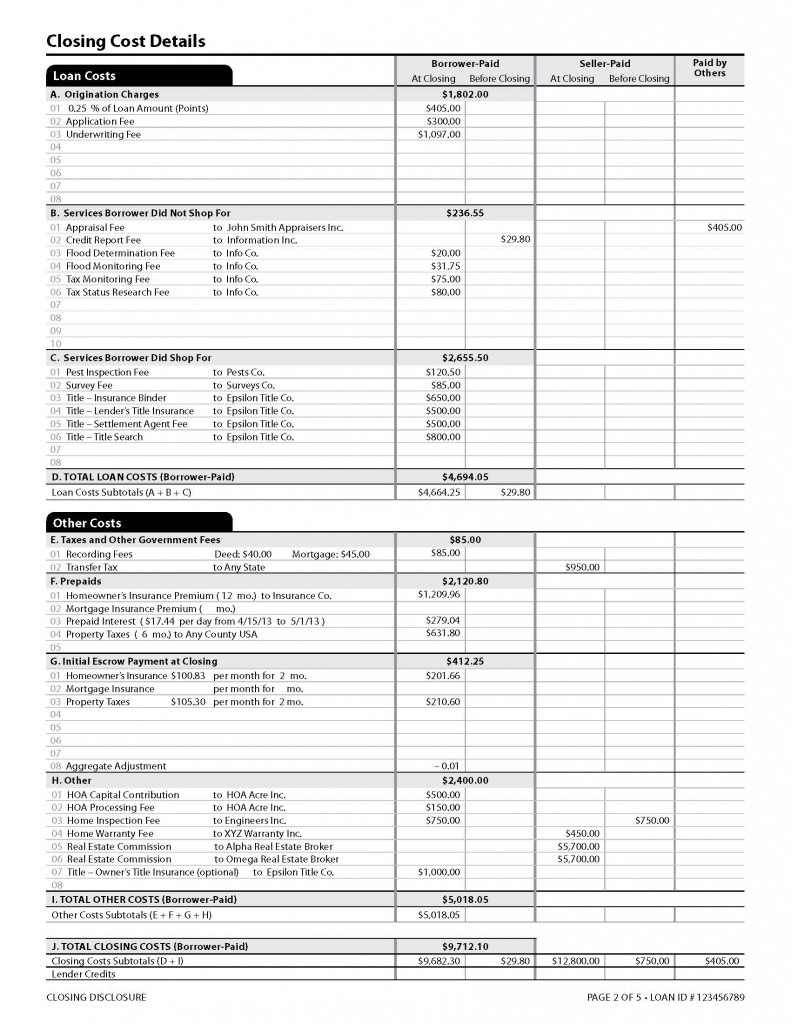

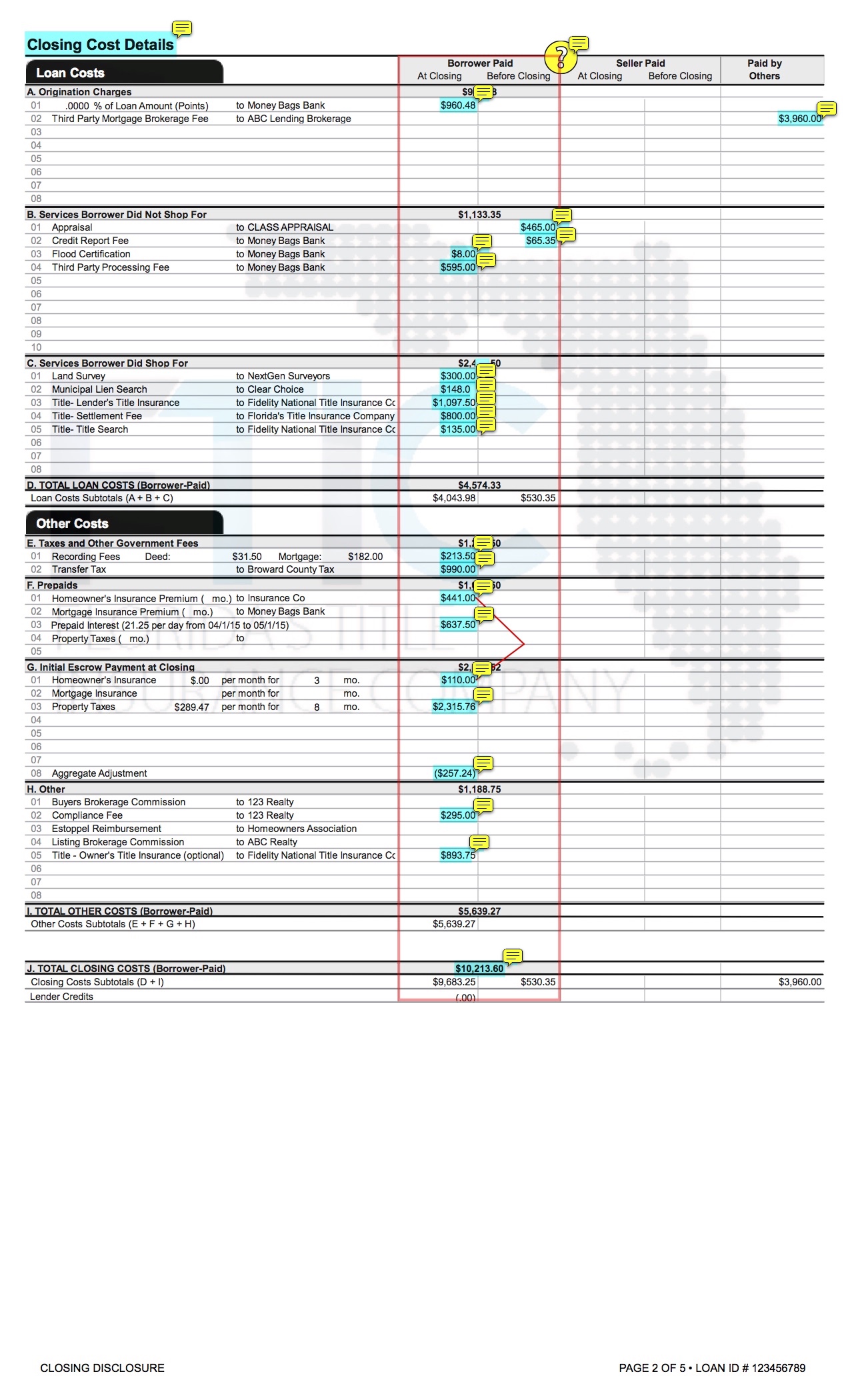

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Mandatory Disclosures To Consumer

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

What Is A Closing Disclosure Lendingtree

Truth In Lending Act Tila Consumer Rights Protections

What Is A Closing Disclosure Lendingtree

Can I Get A Hud Florida Agency Network

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company